Summary

• UK house price inflation at -0.8% on rising sales volumes

• Stron sales activity in first weeks of January on back of pent-up demand end of 2023 and sub-5% mortgage rates

• London & East England lead demand increase

• Demand up 12% year-on-year

• Sales agreed up 13% year on year – with sales up across all regions

• Supply of homes 20% higher year on year

• Positive start to 2024 but we remain in a buyers’ market

• 1 in 4 across southern England accepting 10% below asking price to secure a sale

• London 13x house price to earnings ratio

2024 Starts strong with positive market activity

A strong sales agreed rebound for the start of 2024, with a 13% increase YOY. Housing demand and sales agreed have registered a strong rebound over the first three weeks of 2024 as sub-5% mortgage rates support market activity. Buyer demand is 12% higher than a year ago but remains 13% below the five-year average, which includes the pandemic ‘boom years’ (2021-2022). Overall a very positive start, supported by the drop in mortgage rates.

Annual price falls continue to slow with increase in demand

Zoopla’s UK house price index recorded annual price falls of -0.8% in December 2023, up from a -1.4% low in October 2023.

This is being supported by increase in demand alongside the lowering of mortgage rates. On a regional basis, the largest price falls are in the East of England (-2.5%) and the South West (-2.2%).

All regions up on sales activity

The end of 2023 was positive with an increase in agreed sales, with the trend continuing into 2024. The start of 2024 is 13% higher YOY, along with positive numbers in all regions. The highest increase is in Yorkshire and the Humber (+19%) and the West Midlands (+17%). This shows that the pricing between buyers & sellers are more aligned.

Overall supply is 22% higher than last year, boosting buyers’ choice and keeping prices in line.

Still a buyers’ market

It’s a very positive start to 2024 for the property market, but it’s important not to get carried away, it’s still a buyers’ market in current conditions. Average mortgage rates have fallen to 4.2% over Q1 2024, which supported sales volumes and led to firmer pricing and modest price falls. The rates are continuing to lower and expect this to continue supporting the sales volumes.

It’s realistic to expect house prices to be kept at similar pricing with modest falls, and unlikely growth due to several factors. Firstly, an increase in supply will give buyers more choice, specifically in the larger homes. Secondly, half of those with a mortgage are yet to refinance onto higher rates, this is an important factor, as many would-be buyers are up-sizers who will need a larger mortgage to move to a bigger home. Higher repayments will ensure buyers remain price sensitive and focused on value for money.

Thirdly, a small but not insignificant number of sellers continue to cut asking prices to make sure homes attract buyer interest, continuing the trend from 2023, with 1 in 5 sellers having to accept more than 10% off the asking price to agree a sale. This is close to 1 in 4 across London and the South-East and rising across the rest of the UK.

Improved market conditions will boost the chances of a good sale, however sellers shouldn't expect to list at a higher asking price and must remain realistic.

London fortunes changing

London and the East of England have led the rebound in new buyer demand in the first weeks of 2024. Most other areas recorded below average increases in demand. Over the last seven years, London has lagged behind the rest of the UK in terms of sales volumes and house price inflation. Zoopla’s house price index shows that London house prices have risen just 13% since the start of 2016. Meanwhile, they are 34% higher across the UK and almost 50% higher in Wales. The average value of a flat in London is just 2% higher over the same period.

Early 2010’s saw London reach ‘peak unaffordability’ in 2016 with a price to earnings ratio of over 15x. A number of factors subsequently hit demand and pricing in the city ( tax changes aimed at investors, Brexit/COVID). This, combined with higher mortgage rates which have hit the most expensive housing markets hardest. Low house price inflation since 2016 and rising earnings means housing affordability in London, measured on a house price to earnings ratio basis, is at its lowest since 2014. However, London housing prices remain expensive by UK standards at 13x earnings. It’s likely the market conditions will continue to improve in London throughout 2024, with earnings rising faster than house prices.

Overview

With adjustments to the mortgage rates ongoing, it was always going to be the case of a period of re-alignment for the UK property market. The continuing lowering of mortgage rates are great, but it seems unlikely rates will fall much further in the near term, remaining in the early 4% range with the best deals for those with big deposits. This will of course support sales volumes and hold off further declines in pricing over 2024. I would suggest this to be the great outcome for 2024, stoppage of price lowering and increase in sales volumes.

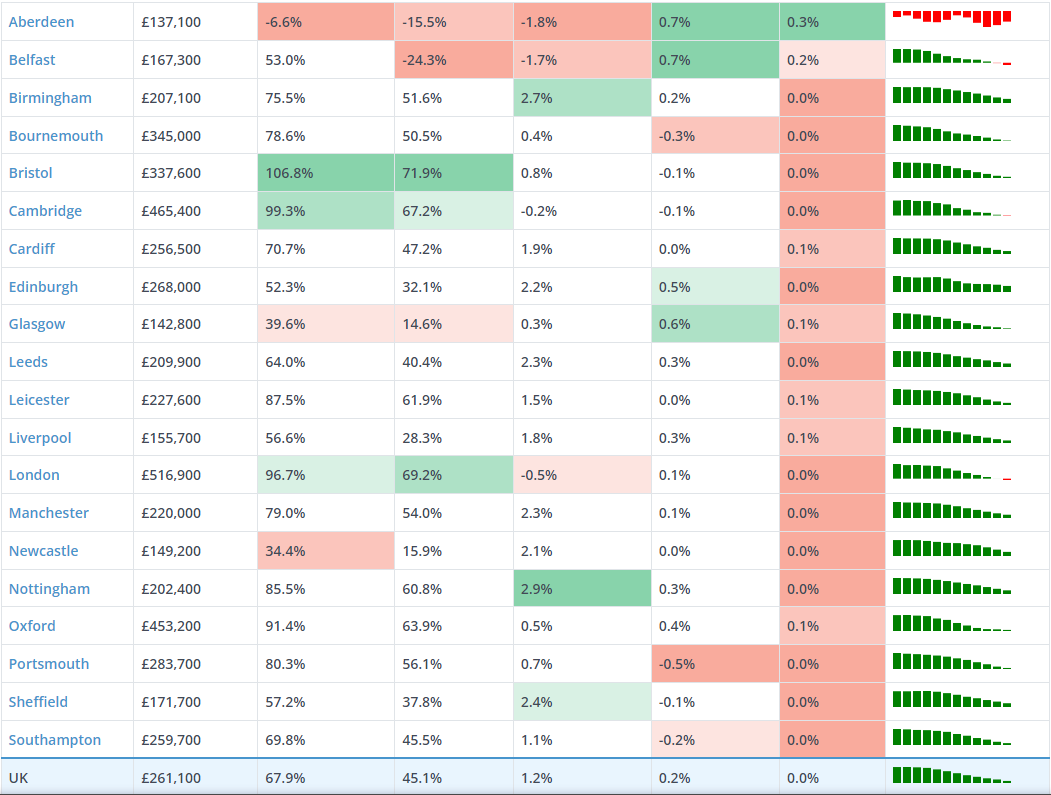

Check out the latest home price index below:

Information generated from Zoopla, hometrack, Rightmove & home.