Reasons to Make the Move and what to consider

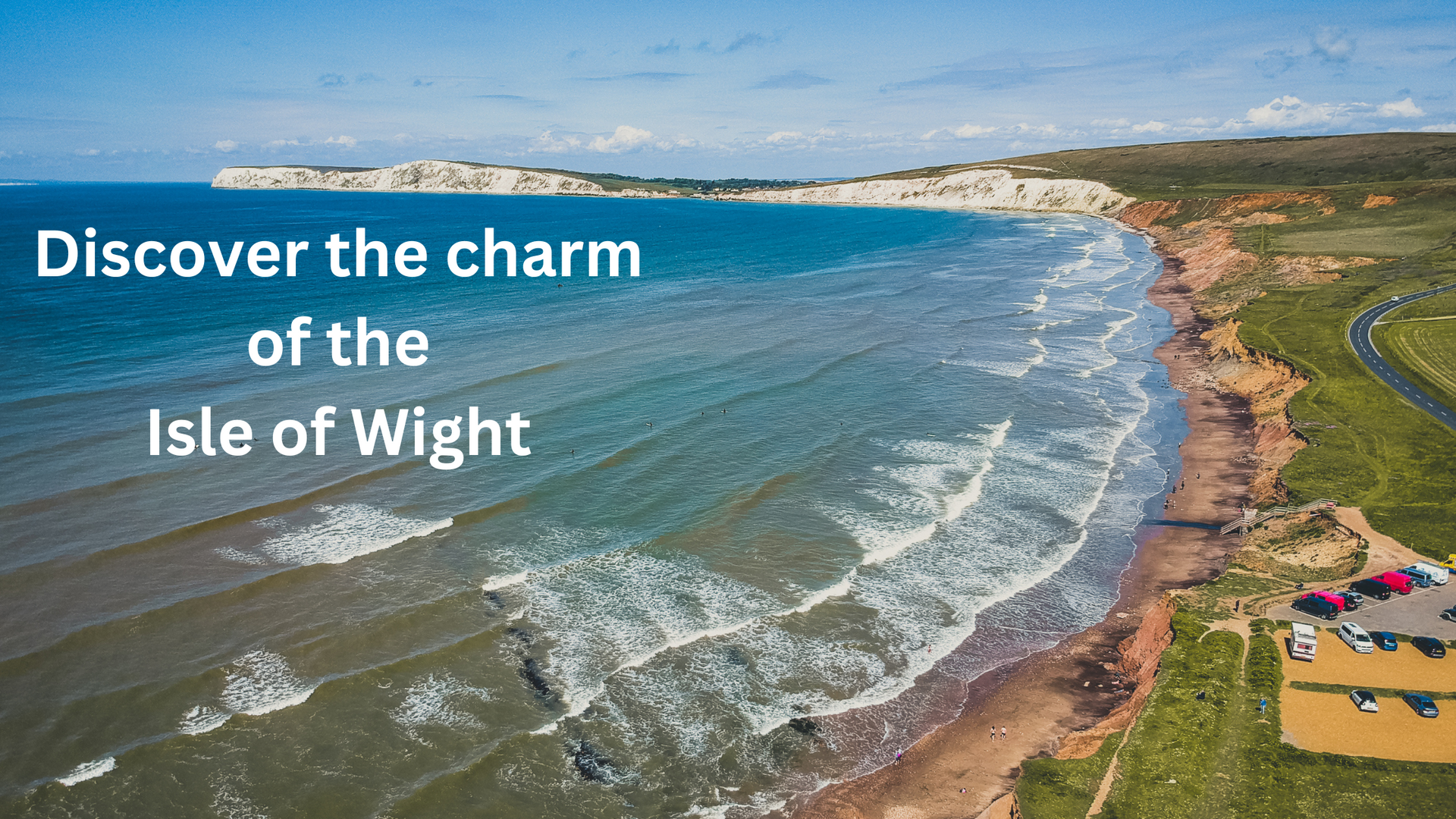

Nestled off the south coast of England, the Isle of Wight boasts stunning natural beauty, rich history, and a relaxed island lifestyle that attracts visitors and residents alike. If you're considering a move to the Isle of Wight, you're in for a treat. In this blog, we’ll explore the reasons why you might want to make the move and offer insights into things to consider when relocating to this idyllic island.

Key points on Why moving to the Isle of Wight could be for you?

1. Natural Beauty:

From picturesque coastal cliffs and sandy beaches to rolling countryside and forests, the Isle of Wight offers an abundance of natural beauty to explore. Whether you enjoy hiking, surfing, cycling, or simply soaking in the stunning scenery, there's no shortage of outdoor adventures to be had on the island.

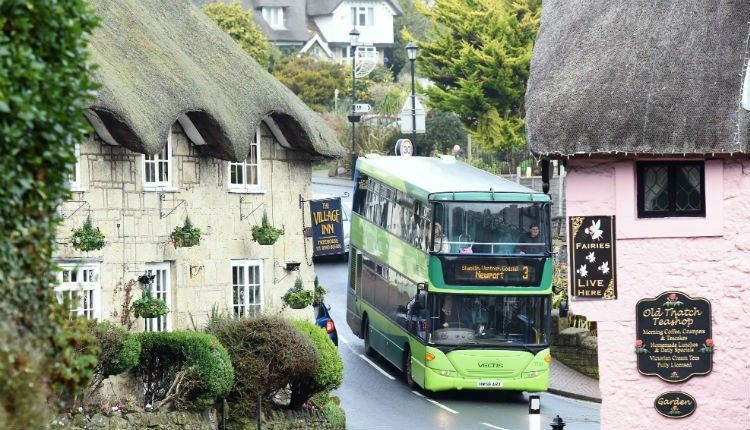

2. Relaxed Island Lifestyle:

Life on the Isle of Wight moves at a more leisurely pace, making it an ideal escape from the hustle and bustle of city living. Enjoy tranquil coastal walks, charming village pubs, and community events that celebrate the island's unique culture and heritage.

3. Rich History and Culture:

The Isle of Wight is steeped in history, with a wealth of historic landmarks, museums, and attractions waiting to be explored. From ancient castles and stately homes to dinosaur fossils and maritime heritage, there's something for everyone to discover on the island.

4. Convenient Location:

Despite its peaceful and secluded feel, the Isle of Wight is conveniently located just a short ferry ride away from the mainland. With regular ferry services connecting the island to Portsmouth, Southampton, and Lymington, commuting to the mainland for work or leisure is easy and convenient.

Things to Consider When Moving to the Isle of Wight:

1. Housing Market:

Take the time to research the housing market on the Isle of Wight and familiarizs yourself with property prices, rental rates, and available housing options. Renting specifically can be difficult due to supply & demand issues, so be sure to understand this before committing.

Below are the average property prices for each main town on the Isle of Wight:

- Yarmouth: £530,000

- Bembridge: £501,000

- Cowes: £345,303

- Freshwater: £335,928

- Ryde: £301,718

- Shanklin: £295,468

- Ventnor: £287,336

- Sandown: £264,012

- East Cowes: £247,936

- Newport: £226,185

2. Transport:

While the Isle of Wight offers excellent public transportation options, including buses and ferries, it's essential to consider how you'll get around the island and access amenities and services.

3. Employment Opportunities:

Research employment opportunities and industries on the Isle of Wight to ensure that your move aligns with your career goals and aspirations. While the island offers a variety of job opportunities in sectors such as tourism, hospitality, and healthcare, it can be limited on corporate opportunities. However, flex/hybrid work has opened a whole new world of opportunities to island residents.

4. Education and Healthcare:

If you have children, consider the quality of schools and educational facilities on the Isle of Wight and ensure that they meet your family's needs and expectations. Similarly, research healthcare services and facilities on the island to access medical care and support when needed. We do have limited doctor surgeries and dental practices.

5. Integration into the Community:

Embrace the opportunity to become part of the island community by participating in local events,joining clubs and getting to know your neighbours. Building connections and friendships will enrich your experience of living on the Isle of Wight and help you feel at home in your new surroundings. It can take time on the Isle of Wight, so be prepared to be patient on this part of the integration to island life.

Moving to the Isle of Wight offers the chance to embrace a laid-back island lifestyle, surrounded by stunning scenery, rich history, and a welcoming community. By considering the factors mentioned above and planning your move thoughtfully, you'll be well-equipped to embark on your exciting island adventure.

Want to talk all things property, whether that's the Isle of Wight, Northern England, London, Dubai or Europe, drop me a message.