Overview

• Annual UK house price inflation at +0.6%

• 60% with over £300k price cutting asking prices by 5% to attract demand

• Annual price falls of up to -2.2% concentrated in southern England on markets with an average price over £300,000

• Other areas of England registering annual house price inflation of over 3.5%

• Buyer demand down 18% in last two months due to mortgage rates

• Rates peaking and already signs of dropping back closer to the 4% region

• Likely to be the southern areas seeing price reductions throughout second half of the year with northern areas performing well

• UK markets till on track to be down by 5% end of year

• Mortgage rates down to 4.99%

• 80% of markets with an average price over £300k registering modest price falls

Mortgage rates drop today

Rates have dropped today (11th August 2023), as the price war between the bigger lenders continue. The best rate available today (according to better.com) is 4.99%, which is 0.73% lower than the start of the week.

We must remember, mainstream media will push the narrative they want to drive. The reality is, lenders make money by lending.

This drop in rate shows that the big lenders believe the bank of England rate may have peaked.

18% Drop in demand due to mortgage rates

During the first six months of 2023 the demand recovered as the mortgage rates fell towards were around 4%, supporting an increase in new sales. Mortgage rates rising quickly over the last six weeks towards 6% has reduced buying power and demand, which has fallen by 18% over the last two months.

The decline in demand is lower than that of the mini-budget in 2022 or when the first lockdown was introduced. Demand is currently 6% weaker than 2019 levels. Sales agreed are only 17% lower year-on-year and we are seeing more committed buyers in the market.

Property price inflation +0.6%

Lower demand and an increase in supply has slowed house price growth to +0.6%, which is down from +9.6% middle of 2022.

There is a clear split between trends in southern England and the rest of the country. With higher mortgage rates having an impact on buying power in the southern areas, where the house prices are the highest.

House prices are falling by up to -0.6%, year-on-year, across all four regions in southern England. However, across the other seven regions of the UK, they are registering +1% growth compared to one year ago.

It’s likely that the price growth between the south and rest of the country will continue to widen over the latter part of 2023. It’s realistic to expect the more affordable markets to not register any price drops in 2023.

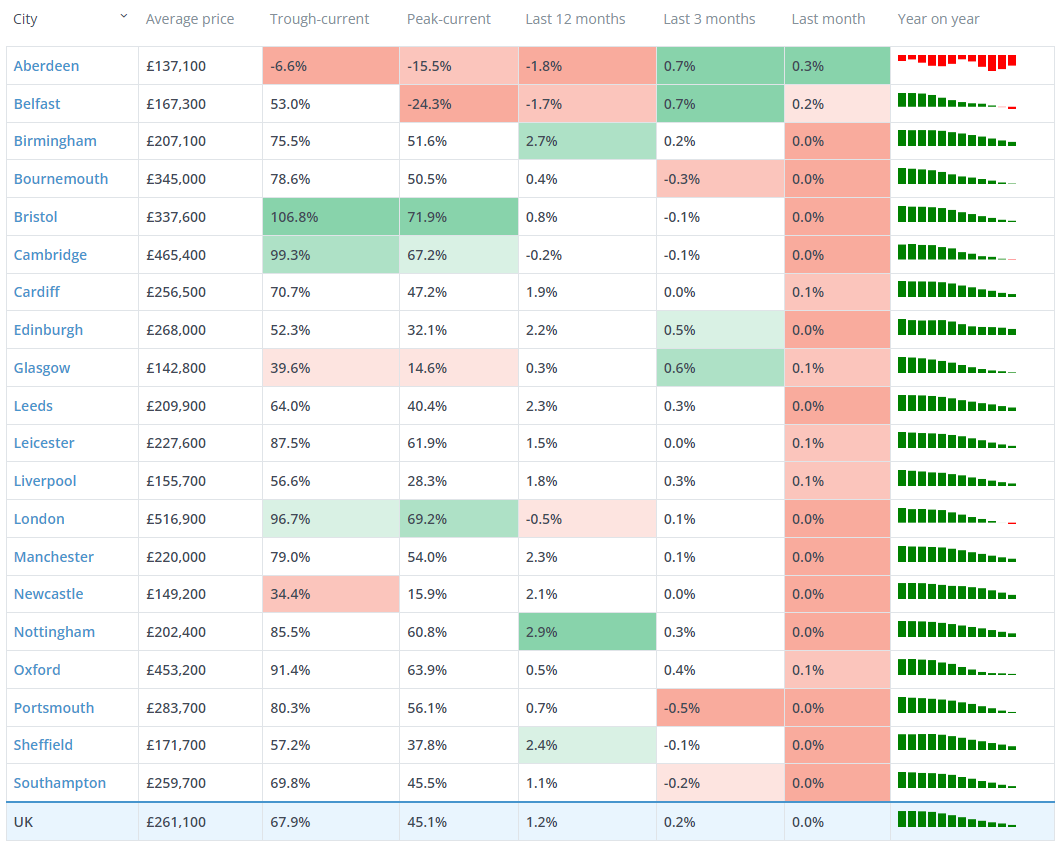

Check out the latest property price index:

Over £300,000, most likely to fall

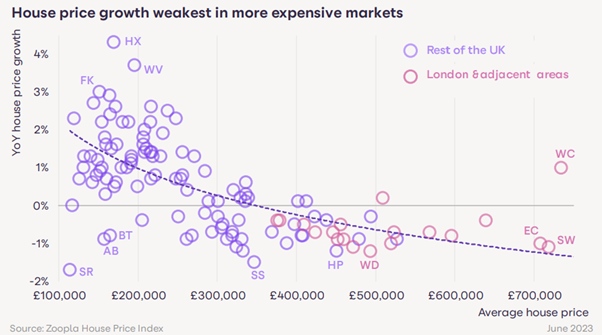

It’s become clear that the property markets in the UK averaging over £300,000, are feeling the impact of higher mortgage rates than other areas. The chart below shows annual price growth compared to average house prices for 121 UK postal areas in June 2023.

Higher house prices mean larger mortgages, bigger deposits and a higher household income required to buy a home. The more the income needed to buy increases, the more households are priced out of the market, which reduces demand.

Housing markets across the South East of England are receiving the largest price falls, most notedly in the commuter markets adjacent to London.

- North West Hertfordshire -1.1%

- Watford -1.2%

- Southend -1.5%

- London - 0.6%

The main reason for this is the property values have registered limited price growth in recent years compared to the rest of England. The only area of London now up over 2023 is west central London at +1%.

Asking price cuts point to lower achieved prices in H2

Trends in asking prices provides important insight into where achieved prices are likely to move in the next 2-6 months. We are seeing prices above £300,000, lowering asking prices by 5% to attract buyers, which is in line with Q4 2022 levels, where we were seeing 6.5% cuts in prices, which is 60% above the 5 year average.

What this means is, buyers have become far more sensible with their offers over recent months, wanting to pay what something is worth, rather than a premium like during the peak.

Shift of the type of homes selling

Over recent years the biggest demand has been in the 3-4 family home market, however with increased pressure on buyers, we are seeing a shift towards buying smaller homes, at a lower price point. The last few weeks have seen a 41% decline in the family home market against the 5 year average. Whilst the rates remain over 5% it is likely to keep this pressure on the higher market.

Thoughts – Property price falls of -5% by end of 2023

Most of the remainder of the year will depend on mortgage rates, however with this increase in supply, it lowers demand, therefore likely to continue to re-balance the market. With the drop in mortgage rates today, it looks less likely that the Bank of England will need to raise rates as much as financial markets expected.

The average mortgage rate for a 5-year fixed rate at 75% loan-to-value has reached 5.42%, compared to 4% in the Spring. It’s likely they have now peaked in pricing.

House prices began to fall in Q4 2022 as mortgage rates for a 75% loan-to-value 5-year fixed rate reached 5.5% late last year. In the first half of 2023 the price falls reversed and actually increased, due to mortgage rates going back towards 4%. With the recent spike in mortgage rates, its realistic to expect this to hit buying power for the remainder of the year.

As per my previous reports, I expect to see UK property prices to fall by up to 5% during 2023, it looks like this is on track to happen.

If this was to happen, the UK property market would still be 15% up compared to the start of the pandemic. House prices are likely to lag behind the growth in price inflation and earnings as house prices adjust to a higher level of mortgage rates.

Statistics show that if the current volume of house sales remain, then we will hit around 1.1 million of homes moved, a very strong year indeed.