Ten Challenges in Nine Months in Memory of Zoe Panayi

Sunday 4th June saw me take on my second challenge of the 10, in memory of my sister Zoe Panayi.

My sister Zoe Panayi lost her battle with cancer on 29th May 2020 at the young age of 26. Zoe was let down substantially by both GP's and beauticians, and we want to change the law! (please read the links below to find out more).

This is my latest update following on from my second challenge so far :)

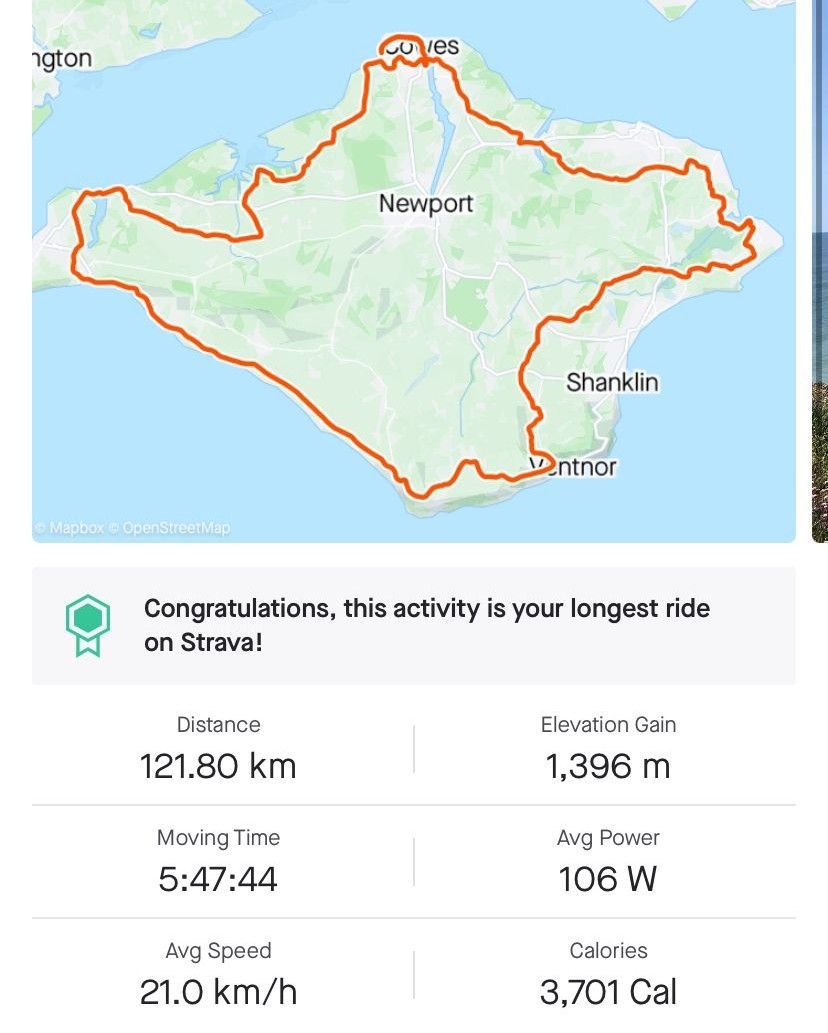

120km Bike Ride around the Isle of Wight

For me this may be the toughest I will take on…to set the picture it was 120KM road cycle, circumnavigating the Isle of Wight (plus 14 miles more), which has far too many hills.

Setting the picture further…I had up-to Sunday morning, never sat on a road bike in my life. The evening & morning prior to setting off I started to feel the pressure of maybe taking on more than I can chew.

My good friends Joe Driscoll and Sam Fryer came along for ‘the ride’ on this one, setting off around 8.30am heading anti-clockwise around the island from Cowes.

This was super tough in every way, learning in how to ‘clip in and out’ of the pedals, using the breaks and gears. Without any time to get to know I was on the road!!

The start of this ride is literally up hill for MILES!! So not the greatest introduction that’s for sure, however I powered through. The first wall I hit was definitely around the 20-26 miles part (Brading), I felt like I had nothing left to give at that point and in my head all I could think was “how am I going to do another 50 plus miles”. Genuinely how I got through this wall…. I thought about my sister and her last day alive. I saw my sister fight with everything she had in her final day to live, so I thought, if she could give what she did I can do a bike ride. This helped me push through the pain at this point and move through some gears and GET IT DONE.

From there I felt pretty good surprisingly so, flowing through to the 58 miles route without finding myself wondering how I can continue. Around 58 miles I hit another wall in Porchfield, however a caffeine gel shot Sam gave me, gave me what I needed to make it through to Cowes.

We got to Cowes… I realised a big problem. I said I would do 74.5 miles on all marketing, we were only at 62 miles in total, therefore I had to figure out how to do another 12.5 miles. So the only option for me was to head down to Gurnard seafront and do laps from there to hit it. Although this in my head sounded an easier option, it turned out that mentally this was far tougher with the fatigue I was feeling to complete than I first thought. However again, with the support of Joe I got through this and completed it on 74.8 miles (beating my target).

Not bad for a first ever road bike ride aye! I want to make special thanks to both Joe & Sam, without them guiding me, offering advice and being there with me I am not sure I would have been able to complete this… So THANK YOU guys.

Walk The Wight 2023

So Walk the Wight was the first of my ten challenges, it says 26.5 miles however it turned out to be just over 28 miles in total! Over some serious incline! I had Josh Younie and Andrew Tapsell join me on this one (Matt & Andrew stopped half way).

Started bright and early at 5am, so I could power through as quickly as possible. I also managed to cross the line with my two year old son (he didn’t do the walk).

Next challenge is 8th July… National 3 peaks within 24 hours!

If you don’t know why I am doing what I am doing, please read the links below, sign and if you can donate. Help me make the biggest change I possible can.

I want to make a special thank you to all those that have donated so far and to the companies that have also supported me so far.

Apex Competitions