Summary

· +12% Rebound in demand over September

· -0.5% Annual UK house price inflation: Ranging from 1.6% in Scotland to -1.5% in South East England regions

· -4.2% completion prices against marketed prices, creating a buyers market in most parts of the UK

· Number of buyers will increase once mortgage rates get below 4.5%, with mortgage rates expected to fall during Q4 of 2023

· Average UK house prices on track to be 2-3% lower over 2023. Which is better than the predicted numbers of 5+%

Demand increased since August

There has been a steady decline in demand over the summer (which is normal in traditional markets), however this has started to reverse. With estate agents seeing 12% more enquiries since the August bank-holiday weekend. The demand still remains 33% lower than a year ago, however in line with 2019. This increase in enquiries reflects improved consumer confidence, which is at a 2-year high, amid expectations of lower mortgage rates.

Demand has improved most noticeably in southern England, where we had seen the biggest drop in enquiries during 2023. Over the last four weeks demand is up 19% in the South East and 16% higher in London.

There has also been an increase in new sales agreed, in line with 2019 levels, partly supported by homebuyers having far better choice as levels of stock have increased to pre-pandemic levels. Much of this is down to sellers still wanting to benefit from realisations of our COVID-19 journey and what is important in life (where/why/who you live).

Price falls on track to be 3% lower over 2023

Most main stream media were out there posting falls of 5/6+% at the start of the year, and most property experts also thought that we could see up to 5% drops. However price falls have been modest over the last year despite the hit to buying power.

Hometrack index recorded a 0.5% price fall over the last year - the first annual decline for over a decade - since June 2012. The most noted price falls are concentrated in southern England, where due to higher house prices, that means more pressure on buying power. In Scotland, where prices are 40% below average, annual house price growth is running at +1.6%.

I expect to see small month-on-month declines throughout the rest of 2023, most likely settling at 2-3% lower than 2022. Important to note, this would still leave average house prices 17% higher than Q1 2020, just before the pandemic.

It's sensible to believe that we will continue to see further small declines in pricing over Q1 of 2024, as the modest drop and potential fall in house prices will not re-establish strong buying power.

Buyers not compromising

Whilst mortgage rates remain over 5%, this reduces buying power over 20% compared to Q1 2022. What we are seeing is homebuyers are unwilling to compromise on the size of home they want, whereas during the peak, buyers were buying 'what they could afford before it was gone'. Share of buyer demand by property type and size is virtually the same as a year ago.

It seems buyers are waiting for the fall in mortgage rates or hoping property prices will fall. Hence the sales volumes are set to be 20% lower this year.

Mortgage rates on track to drop below 5%

The average 5 year fixed rate lone based on 25% deposit is 5.1% across all lenders as of end of September. There is also signs that rates will continue to fall below the 5% region, lower mortgage rates are more likely to improve affordability, and buying power, than falling house prices in the next 12-18 months. This is driven by a better than expected inflation news and pause in base rate rises.

Experts expect mortgage rates to continue to drop steadily over the coming weeks into the late 4%’s. However, its uncertain over the trajectory for inflation and how quickly this will fall back to the Bank of England’s 2% target.

What has shown over the last year is that rates over 5% will mean less buying power - in tern affecting selling prices. If rates drop below 5% then more buyers will be able to return to the market, supporting better completed sales moving into 2024.

It's a buying market - Owners discounting to achieve agreed sale

There are 80% more homes for sale now, compared to September 2021, naturally meaning it shifts the market into a buyers market. Although a buying market sounds great, this doesn't mean there is as much downward pressure as people had expected, for the reasons already stated.

On average sellers are accepting 4.2% lower than asking price to get a sale agreed, this is still better than late 2018. The largest discounts are being seen in London and the South East with 4.8%, compared to the rest of the UK at 2.8%

Overview

With higher borrowing costs the UK property market continues to adjust, it's natural when mortgage rates have more than doubled since 2021, along with the increase with the cost of living, means huge adjustments for home buyers.

Considering the hit to buying power with the increase in mortgage rates, the impact on pricing has been far better than expected by most industry experts. The biggest impact has been on housing sales volumes, which are still on track to total 1 million in 2023, a fifth lower than 2022. While demand remains below average, new sales volumes are holding up better, tracking above 2019 levels. This is evidence that buyers are still serious about moving home, most likely due to the drive of COVID experiences still and the importance of who and where people live.

Many buyers delayed home moving whilst base rates moved so highly, however there are now signs that seeing them settled and somewhat lower, buyers are returning to the market. Many are continuing to wait on the outlook for mortgage rates while also holding out on their property requirements for their next purchase.

The faster mortgage rates move towards 4.5% or lower, the sooner buyers will return to market in numbers. The most likely expectation would be towards the latter end of Q1 2024. This won't necessarily mean prices will suddenly shoot up, however what it will do is stop the decline, support sales volumes and market liquidity. Prices as I stated back in early 2022 still need to move slightly lower to re-adjust to what was a huge spike in a short amount of time during the pandemic. This will mostly be seen in the higher priced areas, and likely no change or increase in the more affordable areas.

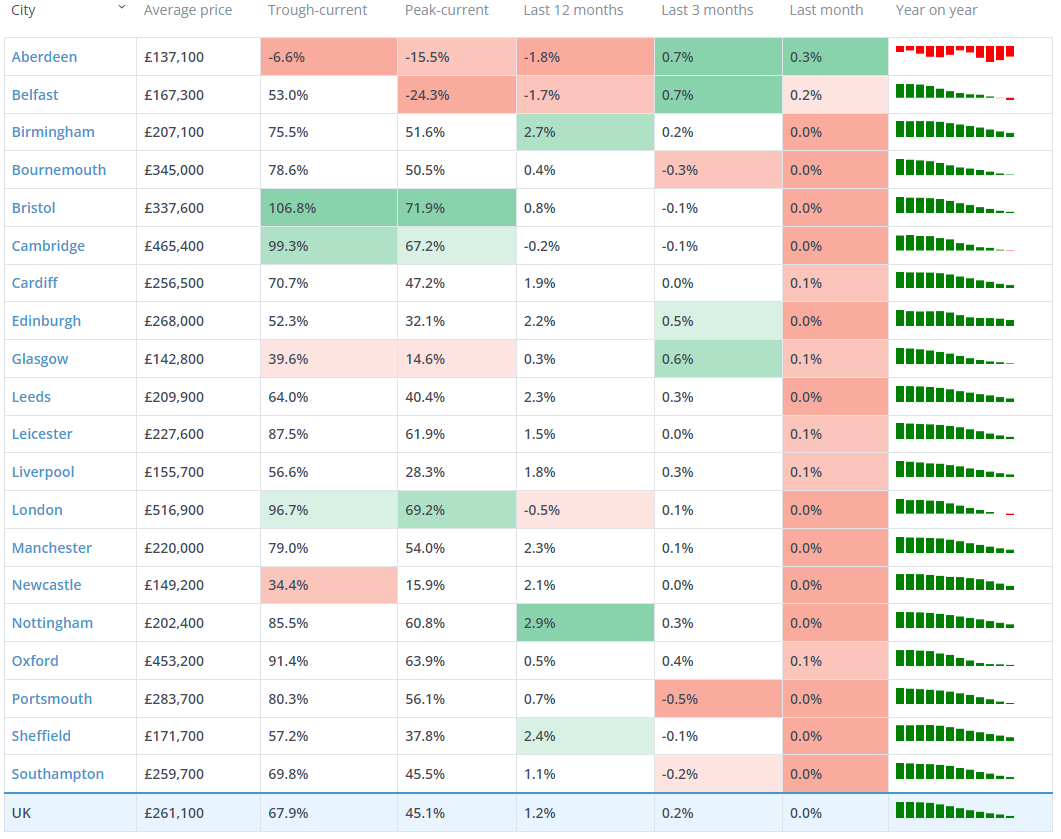

See the latest city chart below: