Summary

• Lowest mortgage rates for 15 months

• Buyer demand and sales agreed up by over a quarter since 2023

• UK house prices up 0.7%, from -0.3% a year ago

• House prices are rising by up to 2.5% in more affordable areas

• Almost a third of homes for sale are ‘chain-free’ as investors and second home owners sell in face of recent and possible tax changes

• Some coastal and rural areas see supply of homes for sale up 40% on last year

The UK property market has continued to recover steadily through September, with house prices increasing slightly by 0.7% over the past year. This shift is subtle but marks a notable improvement from the -0.3% drop experienced a year ago. The rebalancing is largely supported by falling mortgage rates and an increased number of homes coming onto the market, particularly chain-free properties. While prices are climbing, buyer caution is still evident as affordability remains a key challenge in certain regions. As long as properties are priced correctly, they are moving!

Buyer Demand Rising

Buyer demand has surged by 26% compared to this time last year. Lower mortgage rates are the main driver of this renewed activity. The average rate for a 5-year fixed mortgage at 75% LTV now sits at 4.3%, a significant drop from 5.5% a year ago. With more favorable financing options, households who had previously held off are re-entering the market. Sales agreed are up 25%, showing buyers are ready to move when the price is right. However, the market remains price-sensitive, with many buyers securing deals below asking prices.

Mortgage Rate Impact

The drop in mortgage rates is a welcome relief for many, providing a much-needed boost in affordability. The competition among lenders is particularly beneficial for buyers with larger deposits. The market has now seen the lowest mortgage rates in 15 months, and this is expected to stabilise around the current levels, with rates hovering in the mid-3% to low-4% range through early 2025. This continues to encourage prospective buyers, though affordability constraints remain particularly acute in the South.

Supply and Chain-Free Properties

One of the defining features of the current market is the influx of chain-free properties. Nearly 32% of homes for sale are now chain-free, driven largely by investor and second-home sales as owners react to anticipated tax changes. Coastal and rural areas, such as Bournemouth and Torquay, have seen a 40% rise in supply as these properties hit the market. Additionally, more homes listed for sale had previously been rented out, with landlords particularly concentrated in London and the South East selling off due to higher borrowing costs and low rental yields.

Regional Price Variations

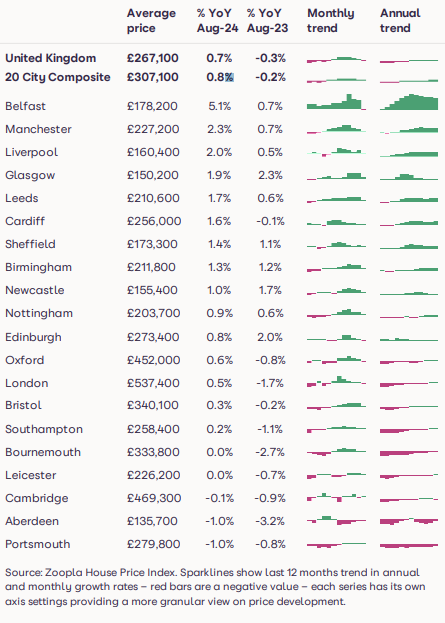

There are stark contrasts in price performance across the UK. Northern Ireland leads the way with house prices up by 5.7% year-on-year, while cities like Manchester and Liverpool have also seen solid growth at 2.3% and 2.0%, respectively. However, southern regions such as the South West and South East remain under pressure, with price declines persisting in some areas. London, after seeing a 1.7% drop last year, has rebounded slightly with a 0.5% rise, though affordability continues to be an issue for many first-time buyers in the capital.

Outlook

Looking ahead, the market is expected to maintain its current trajectory of modest price growth, particularly in more affordable regions. While the broader economic outlook remains uncertain, a combination of stable mortgage rates and a higher level of household incomes should help sustain the market into 2025. Sellers, however, must stay realistic with their pricing, as buyers continue to prioritise affordability and value for money. Price-sensitive buyers, combined with a growing number of homes on the market, will keep house price inflation in check for the foreseeable future.

Check out the latest city performance through the UK:

Want to talk UK property, investment or how to start? Drop me an email to talk further

Information gathered from personal knowledge of market, rightmove, zoopla and hometrack.